3.4 Balance of Payments

By the end of this unit you should be able to:

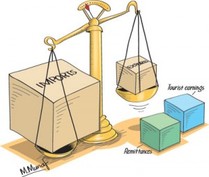

- Explain the four components of the current account, specifically the balance of trade in goods, the balance of trade in services, income and current transfers.

- Distinguish between a current account deficit and a current account surplus.

- Explain the two components of the capital account, specifically capital transfers and transaction in non-produced, non-financial assets.

- Explain the three main components of the financial account, specifically, direct investment, portfolio investment and reserve assets.

- Explain how the current account and the financial account are interdependent.

- Explain why a deficit in the current account of the balance of payments may result in downward pressure on the exchange rate of the currency.

- Discuss the implications of a persistent current account deficit, referring to factors including foreign ownership of domestic assets, exchange rates, interest rates, indebtedness, international credit ratings and demand

- Explain why a surplus in the current account of the balance of payments may result in upward pressure on the exchange rate of the currency.