2.5 Unemployment

By the end of this unit you should be able to:

- Explain what is meant by unemployment

- Explain the difficulties involved in measuring unemployment

- Discuss the costs of unemployment

- Distinqush between the different causes of unemployment

- Evaluate the measures that may be taken to reduce unemploymeny

What is unemployment, and what is it not?

Most governments have the key macroeconomic objective of achieving low levels of unemployment. Not being employed does not necessarily mean being unemployed. The unemployed consist of those registered as able, available and willing to work but cannot find work despite an active search.

It is not just somebody who doesn't have a job!

Stay at home mothers and fathers, the retired, students and prisoners are all people who are not working, but neither are they actively seeking work – these people would not figure in the unemployment rate for a country or region.

It is not just somebody who doesn't have a job!

Stay at home mothers and fathers, the retired, students and prisoners are all people who are not working, but neither are they actively seeking work – these people would not figure in the unemployment rate for a country or region.

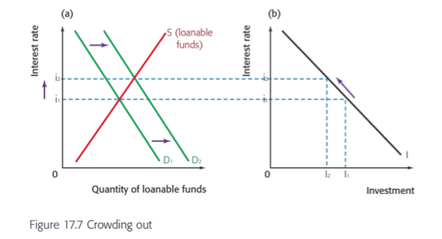

Crowding Out

When governments run budget deficits in order to finance government spending to boost the economy a problem known as ‘crowding out’ can occur. To generate money for government spending, governments sell bonds to financial institutions such as banks, who then sell these on to consumers. What they are essentially doing to increasing demand for savings.

Here should have noticed a paradox as the government spends money to boost the economy, but by selling bonds they are increasing demand for savings which leads to less consumer and investment spending.

The given amount of savings in the economy is represented by the loanable funds curve. The price of these loanable funds is the interest rate. The increased demand for savings from D1 to D2 results in an increased interest rate from i1 to i2.

So even though the government wishes to increase aggregate demand (C+I+G+(X-M) by increasing government spending, the higher interest rate causes interest-sensitive private investment to fall, thus reducing aggregate demand.

Another way that the government can raise funds for spending is by raising taxes. As you know this can lead to a reduction in consumer and business spending and therefore a decrease in aggregate demand.

If the government raises the money for spending by taking out loans from banks then there will be less credit available to firms for investment and thus a decrease in aggregate demand. Also, the sheer amount of money the government is likely to borrow would have an upward pressure on interest rates. Higher interest rates mean firms and consumers are less likely to borrow and therefore spend.

Here should have noticed a paradox as the government spends money to boost the economy, but by selling bonds they are increasing demand for savings which leads to less consumer and investment spending.

The given amount of savings in the economy is represented by the loanable funds curve. The price of these loanable funds is the interest rate. The increased demand for savings from D1 to D2 results in an increased interest rate from i1 to i2.

So even though the government wishes to increase aggregate demand (C+I+G+(X-M) by increasing government spending, the higher interest rate causes interest-sensitive private investment to fall, thus reducing aggregate demand.

Another way that the government can raise funds for spending is by raising taxes. As you know this can lead to a reduction in consumer and business spending and therefore a decrease in aggregate demand.

If the government raises the money for spending by taking out loans from banks then there will be less credit available to firms for investment and thus a decrease in aggregate demand. Also, the sheer amount of money the government is likely to borrow would have an upward pressure on interest rates. Higher interest rates mean firms and consumers are less likely to borrow and therefore spend.

Measuring unemployment |

Types of unemployment |

|

|

|