3.1 Sources of finance

What we will study?

By the end of this unit you should be able to:

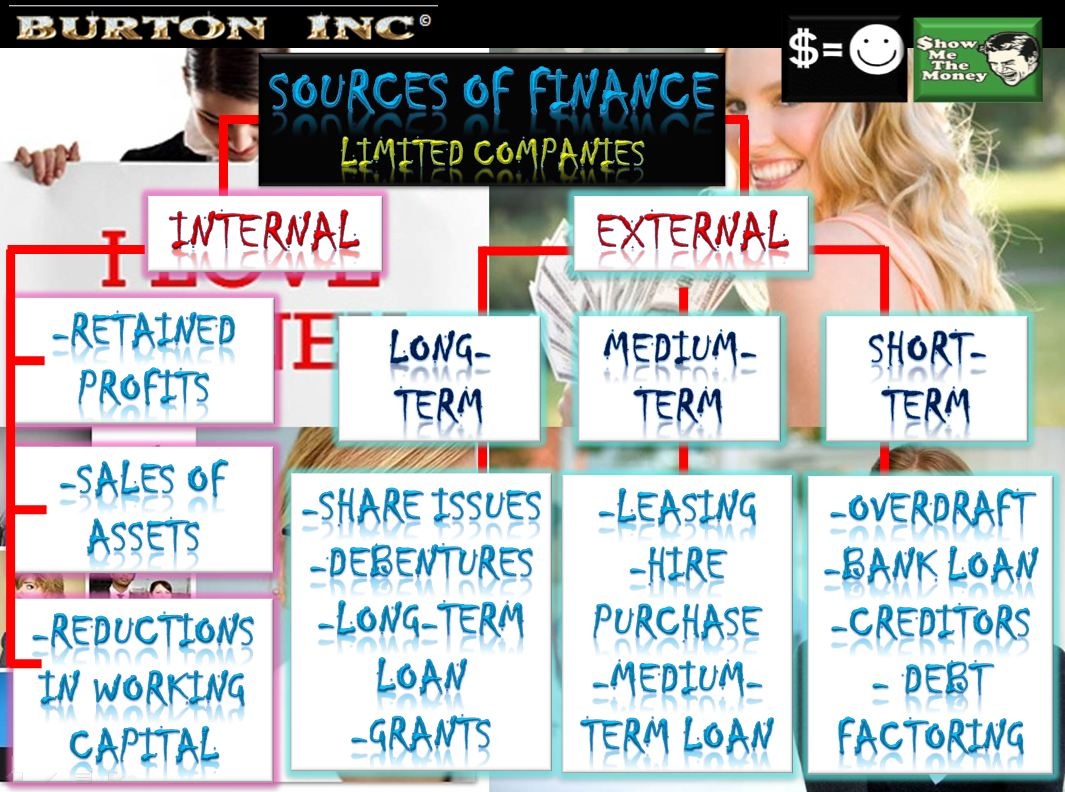

- Understand internal and external sources of finance

- Analyse the different sources of long-term, medium-term and short-term finance

- Understand the role played by the main financial institutions

- Evaluate the advantages and disadvantages of each form of finance for a given situation

REVENUE AND CAPITAL EXPENDITURE

Revenue expenditure is the cash for the daily running of a business such as wages and electricity. Capital expenditure are the funds used by a company to acquire or upgrade physical assets such as property, industrial buildings or equipment. This type of outlay is made by companies to maintain or increase the scope of their operations. These expenditures can include everything from replacing a roof to building a brand new factory.

The difference between the two is that revenue expenditures are costs that are incurred on a regular basis and the benefit from these costs is obtained over a relatively short period of time. Whereas capital expenditures are typically one-off purchases of tangible (physical) assets that are relatively expensive.

The difference between the two is that revenue expenditures are costs that are incurred on a regular basis and the benefit from these costs is obtained over a relatively short period of time. Whereas capital expenditures are typically one-off purchases of tangible (physical) assets that are relatively expensive.

Advantages and disadvantages of different sources of finance

Difference between hire purchase and leasing: with leasing a transfer of ownership never takes place, with hire purchase ownership is transferred as soon as the agreement begins